Navigating customs clearances can be a complex process fraught with regulations and documentation requirements. It plays a crucial role in international trade, affecting the timely delivery of goods and compliance with legal standards. Understanding the customs clearance process ensures that businesses can facilitate smooth transitions across borders and avoid costly delays.

Many individuals and companies might underestimate the value of effective customs management. Missteps can lead to significant fines, delays, or even confiscation of goods. Knowing the essential documentation and procedures is vital for successful shipping and receiving.

In this blog post, readers will gain insights into the customs clearance process, including tips on documentation, potential pitfalls, and best practices. These pieces of information aim to empower readers with the necessary knowledge to handle customs challenges confidently.

Concepts and Importance of Customs Clearances

Customs clearance is a critical process in international trade. It ensures that goods move across borders efficiently while complying with legal and regulatory requirements. Understanding its definition and the roles involved is essential for stakeholders in the logistics and supply chain sectors.

Definition of Customs Clearance

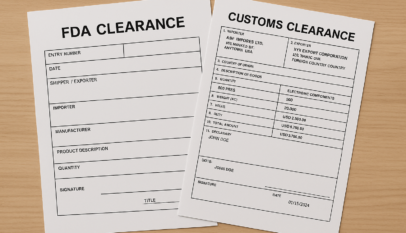

Customs clearance refers to the process of obtaining permission from government authorities for goods to enter or exit a country. This process involves the submission of requisite documentation, including invoices, shipping manifests, and permits.

Importantly, customs clearance aims to verify that all applicable tariffs and duties are paid and that the items comply with local laws. Non-compliance can lead to delays, fines, or confiscation of goods.

Roles and Responsibilities in Clearance Process

Several key players are involved in the customs clearance process. These include:

- Importers and Exporters: Responsible for providing accurate documentation and ensuring compliance with customs regulations.

- Customs Brokers: Professionals who act as intermediaries between importers/exporters and customs authorities. They ensure paperwork is correctly prepared and submitted.

- Customs Authorities: Government agencies that oversee the clearance process, enforce compliance, and conduct inspections.

Each role carries specific responsibilities that contribute to the overall efficiency of the customs clearance process. Failure in any part can lead to complications that affect shipping timelines and costs.

Customs Clearance Procedures

Customs clearance involves essential documentation and steps that ensure goods move smoothly across borders. Understanding the key components can facilitate a more efficient customs process.

Documentation Required for Customs Clearance

Customs clearance requires various documents. The primary documents include:

- Commercial Invoice: Lists the goods and their value.

- Bill of Lading: Confirms the receipt of shipment and details shipping terms.

- Packing List: Details the contents of each package.

- Import/Export License: Required for controlled goods, depending on the country.

- Customs Declaration: Form submitted to customs authorities, declaring the contents.

Accurate and complete documentation helps to avoid delays and penalties during clearance.

Step-by-Step Customs Clearance Process

- Preparation of Documents: Collect all necessary documents, ensuring they are accurate and reflect the shipment details.

- Submission to Customs: Submit the documents to the appropriate customs authority. This may vary by destination.

- Assessment by Customs Officials: Customs reviews submitted documents. They may request additional information or inspections.

- Duties and Taxes Calculation: Customs calculates applicable duties and taxes based on the value and nature of the goods.

- Payment of Duties and Taxes: Importers must pay required charges to release goods.

- Release of Goods: Once cleared, goods are available for pickup or delivery.

Proper execution of these steps minimizes the risk of issues during customs clearance.

Common Challenges and Solutions

Challenges in the customs clearance process can arise frequently. Some common issues include:

- Incomplete Documentation: Missing documents can lead to delays. Ensuring all necessary paperwork is ready before shipment is crucial.

- Valuation Disputes: Customs may challenge declared values. Providing comprehensive invoices and documentation can help clarify any disputes.

- Regulatory Changes: Changing regulations can complicate processes. Staying updated on relevant laws is essential for compliance.

- Inspections: Random inspections can delay clearance. Preparing for potential inspections by maintaining organized documentation helps.

Implementing these solutions can ease the customs clearance process and reduce complications.

House for Sale at Mississauga: Top Listings and Market Insights

Many buyers are interested in finding a house for sale in Mississauga due to its diverse n…